Welcome to Estongar Recipes

Discover easy, delicious, and globally inspired recipes made for everyday cooking. Whether you're a kitchen pro or just starting out, there's something flavorful here for you.

Recent Posts

Check out the latest recipes fresh from our kitchen!

Hello! I'm Samantha, the passionate home cook behind Estongar Recipes. I created this blog to share simple, delicious meals that anyone can enjoy — no fancy tools or complicated steps, just real food made with heart. From cozy breakfasts to vibrant dinners, my goal is to inspire your everyday cooking.

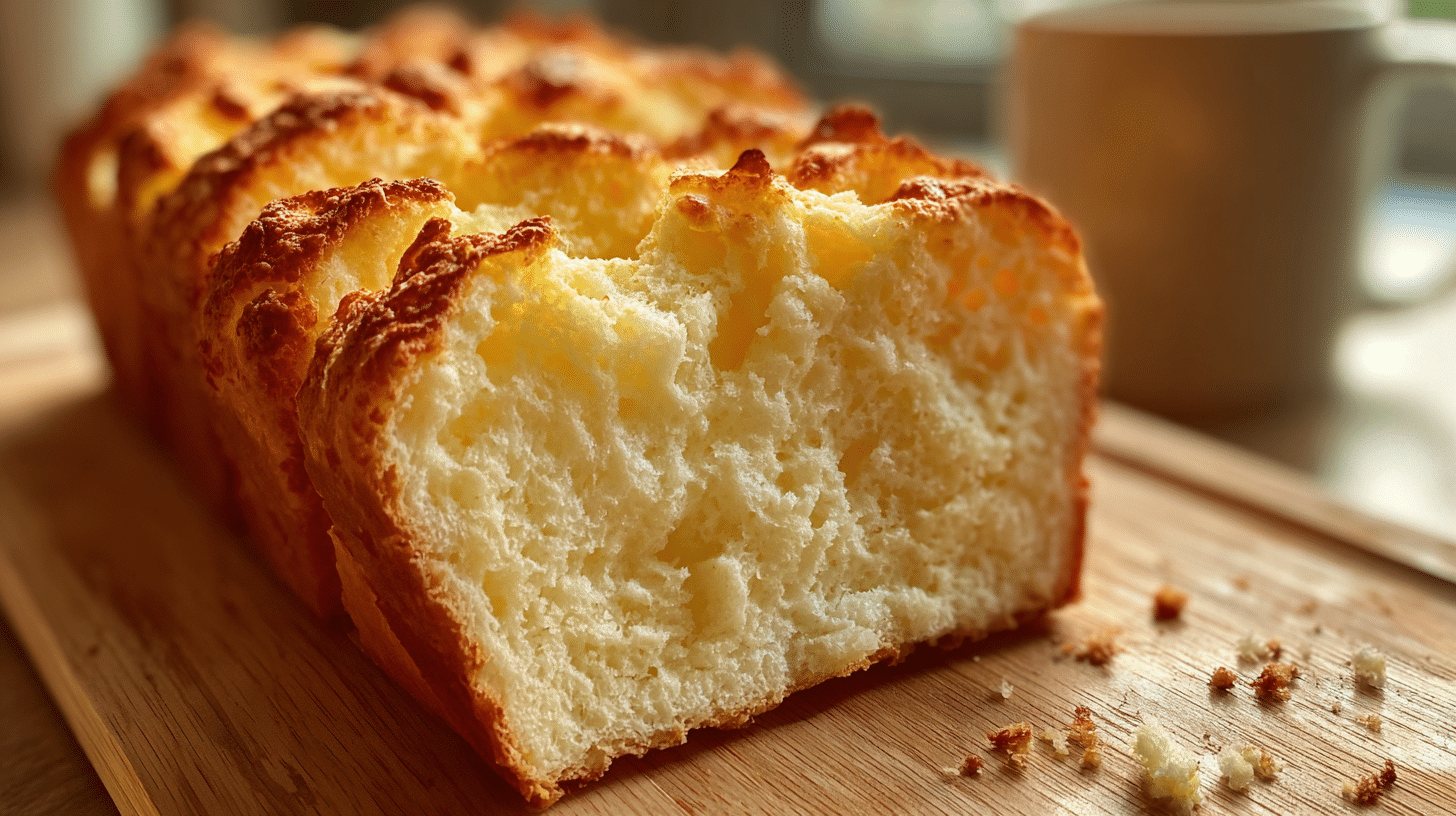

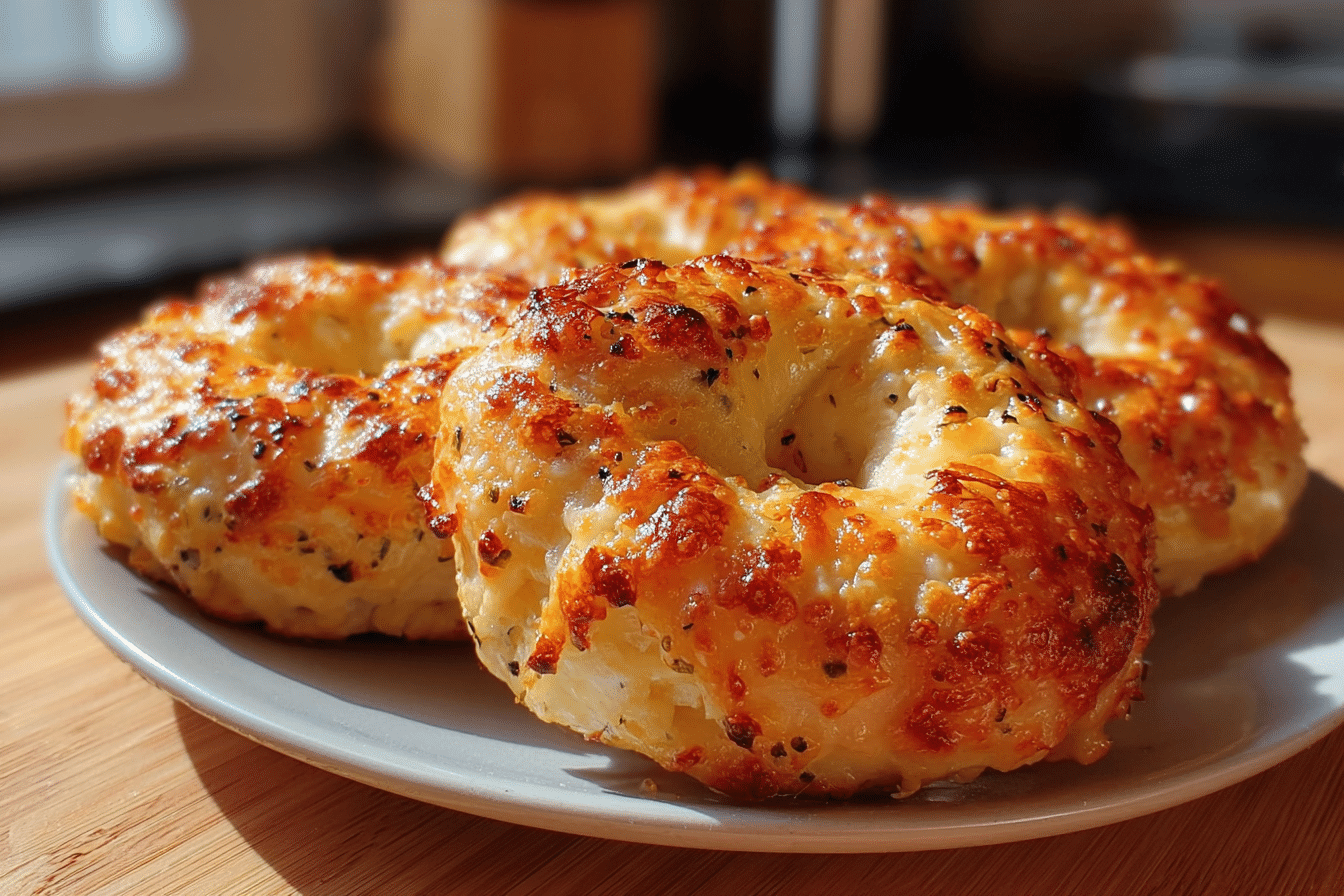

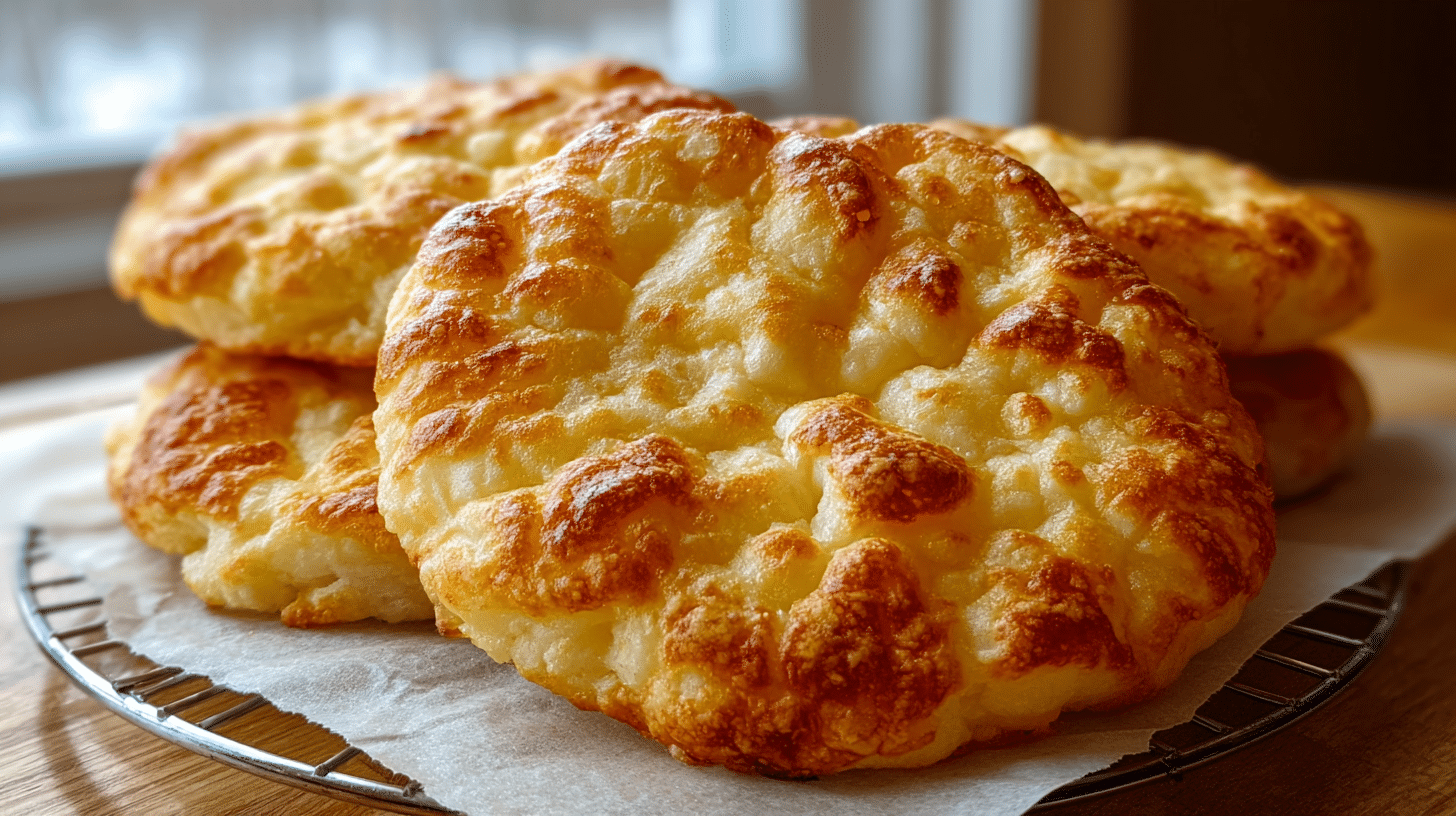

Breakfast Recipes

Start your day right with these easy, delicious, and energizing breakfast ideas — from fluffy pancakes to healthy smoothies.

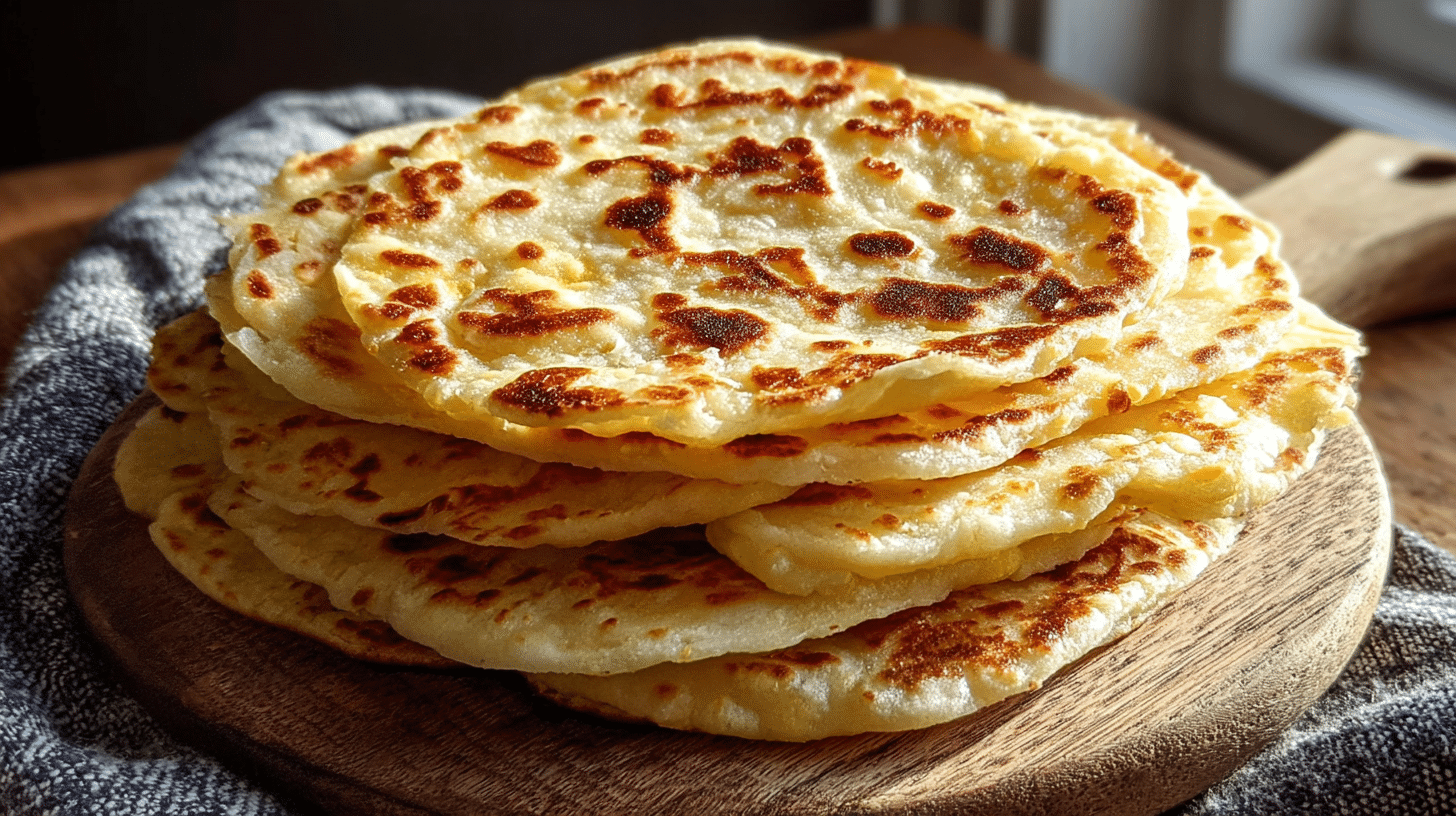

Lunch Recipes

Find fresh and satisfying lunch ideas perfect for any day of the week.

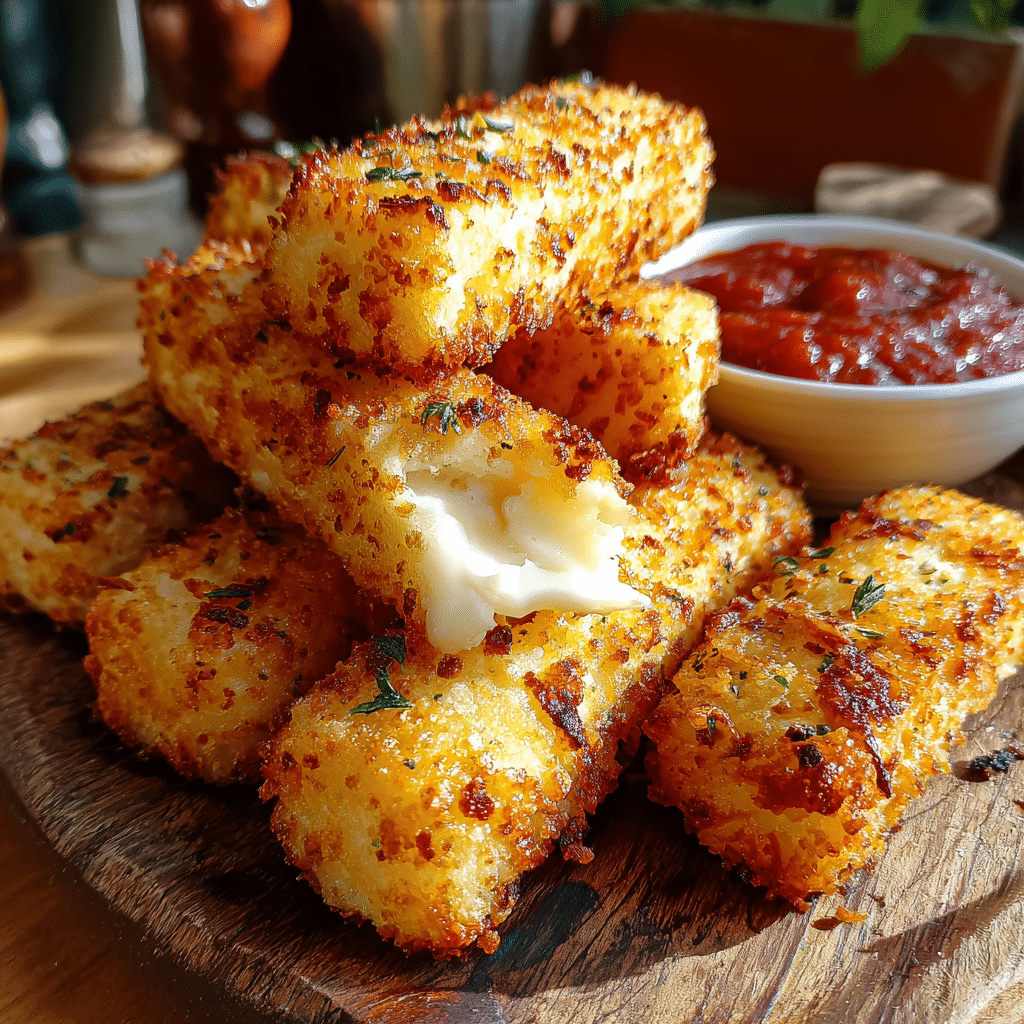

Dinner Recipes

End your day with hearty meals full of comfort and flavor.

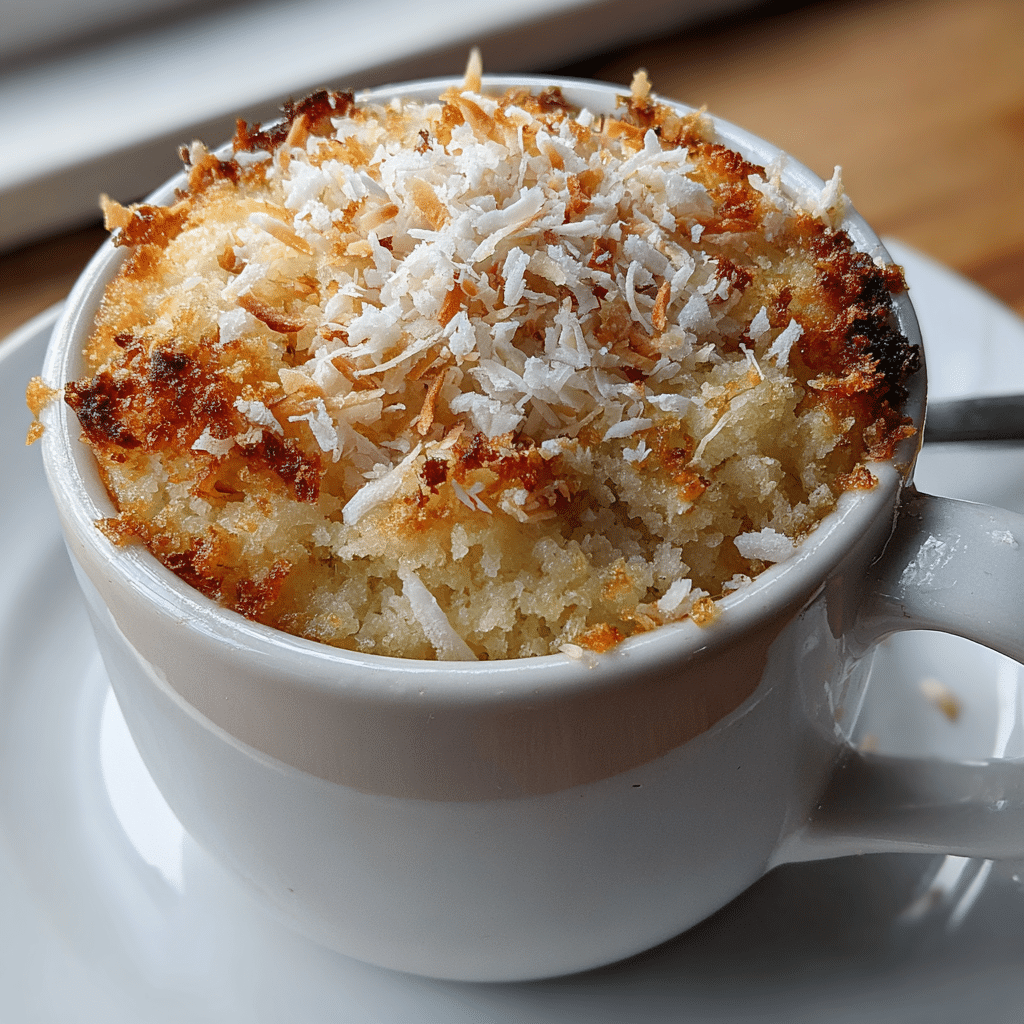

Sweet Desserts

Satisfy your sweet tooth with cakes, cookies, and more.